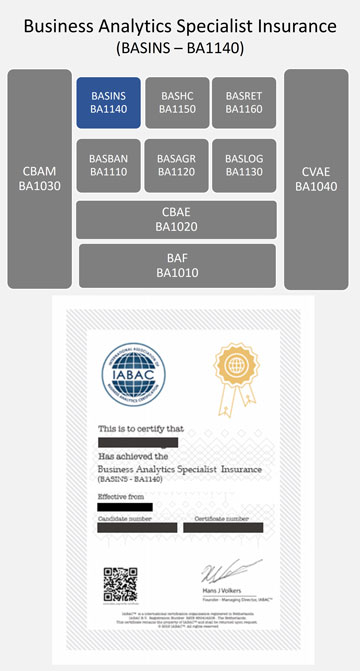

Prerequisite Certification

- Understand insurance industry: Gain knowledge of processes, products, regulations, and trends for effective data analysis.

- Master data analysis tools: Learn Excel, Python, R, or SQL to analyze and visualize insurance data for informed decisions.

- Develop analytical skills: Solve complex business problems using data-driven approaches for actionable recommendations.

- Acquire insurance domain knowledge: Understand concepts, terminology, and KPIs to interpret data and provide valuable insights.

- Enhance communication skills: Clearly communicate findings and recommendations through reports and presentations for impactful change.

Who can pursue this certification?

Insurance Analysts: Professionals working as insurance analysts or underwriters who are responsible for assessing risk, pricing insurance products, and making data-driven decisions may pursue this specialization to strengthen their analytical skills and gain expertise in using analytics to evaluate and mitigate insurance risks.

Actuaries: Actuaries who work in the insurance industry and are responsible for analyzing data, evaluating risk, and determining insurance premiums may pursue this specialization to enhance their analytical and modeling skills specific to insurance.

Risk Managers: Professionals in risk management roles within insurance companies or risk consulting firms may pursue this specialization to develop expertise in using analytics to identify and mitigate risks, improve risk management strategies, and optimize insurance portfolios.

Insurance Operations Professionals: Individuals involved in insurance operations, claims management, policy administration, or insurance technology may pursue this specialization to enhance their understanding of data-driven approaches to streamline processes, improve customer experience, and optimize operational efficiency within the insurance industry.

Insurance Consultants: Consultants specializing in insurance advisory services, data analysis, or insurance technology may pursue this specialization to strengthen their expertise in using analytics to address insurance industry challenges, support decision-making, and provide insights to clients.

Insurance Product Managers: Professionals responsible for developing and managing insurance products may pursue this specialization to gain a deeper understanding of customer behavior, market trends, and data-driven product development strategies within the insurance industry.