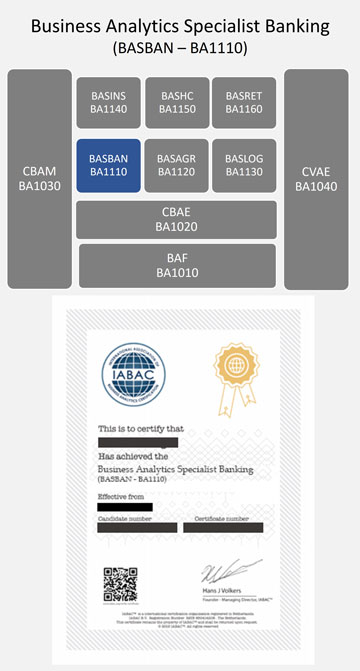

Prerequisite Certification

There is no mandatory prerequisites for BASBAN certification. It is recommended to have

Prerequisites for Pursuing Business Analytics Specialist Banking Certification:

- Basic Analytics Knowledge: A foundational understanding of analytics concepts, such as statistical analysis and data interpretation, is beneficial before pursuing this certification.

- Banking Industry Familiarity: Having familiarity with the banking industry, its operations, and key financial concepts will provide a solid foundation for applying analytics in a banking context.

- Proficiency in Data Analysis Tools: Prior experience or proficiency in using data analysis tools, such as Excel, SQL, or statistical software, is advantageous for effectively working with financial data sets.

- Business Acumen: A strong understanding of business principles and the ability to connect analytics insights with business objectives is crucial. Knowledge of key banking metrics and performance indicators is valuable.

Who can pursue this certification?

Banking Professionals: Individuals currently working in various roles within the banking sector, such as retail banking, commercial banking, investment banking, risk management, credit analysis, or compliance, may pursue this specialization to acquire specialized knowledge and skills in using analytics to address banking-specific challenges and opportunities.

Data Analysts and Data Scientists in Banking: Professionals working as data analysts or data scientists within the banking industry may pursue this specialization to gain a deeper understanding of banking operations and develop expertise in applying advanced analytics techniques to derive insights from banking data.

Risk and Compliance Professionals: Risk managers, compliance officers, and professionals involved in managing regulatory compliance within the banking industry may pursue this specialization to leverage analytics in assessing and mitigating risks, identifying fraud patterns, and ensuring compliance with industry regulations.

Business Intelligence and Reporting Professionals: Individuals responsible for generating reports, dashboards, and business intelligence solutions within banking organizations may pursue this specialization to enhance their ability to analyze and present banking data effectively, improving decision-making at various levels within the organization.

Financial Analysts and Investment Managers: Financial analysts and investment managers who work in the banking industry may pursue this specialization to deepen their understanding of data-driven investment strategies, portfolio analysis, and risk assessment in the context of banking.

Banking Consultants: Consultants specializing in providing advisory services to banks and financial institutions may pursue this specialization to strengthen their expertise in leveraging analytics to solve banking-specific challenges and support clients in making data-driven decisions.